Competitive Interest Rates

By using assets as collateral when applying for a new loan, you'll lower the risk to the lender which will be reflected by lower rates of interest.

For SMEs, attracting the capital that your business needs to grow can be challenging, particularly when it comes to sourcing a competitive rate during the first few years of trading.

Whether you've reached the limit of your existing credit lines or simply wish to secure a lower interest rate on your finance, secured business loans can help.

Property or business assets can be used as collateral to offset risk by offering these as security when applying for finance, helping you to quickly access funds which can be used to help drive your business forwards.

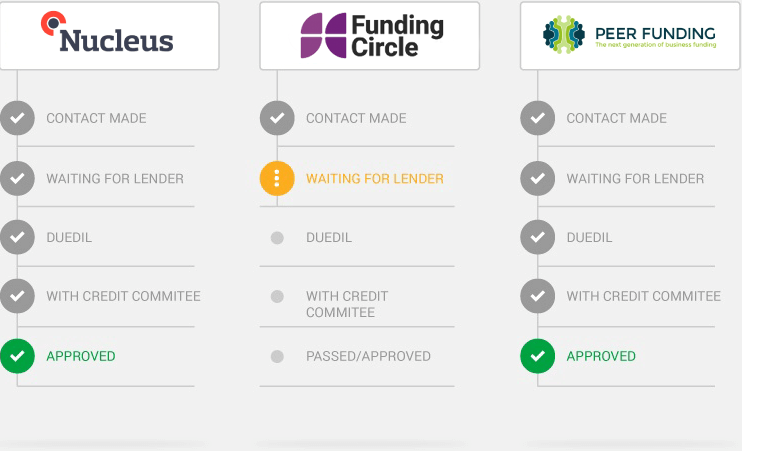

At Capitalise, we work with specialist lenders who can not only provide you with the funds your business needs, but have a proven track record supporting similar businesses within your sector.

Avoid large upfront payments whilst still benefiting from full access to your next company vehicle.

Secured business finance is suitable for fledgling SMEs and mature businesses alike with scaleable advantages that can make them an attractive proposition.

Economic uncertainty has made it harder for some businesses to attract funding through unsecured means, however the need to borrow still remains. Secured small business loans are one of the most common borrowing types used by newer businesses with affordable repayments structured to fit within your projected cash flow.